88rajaslothoki.online

Community

Top Financial Advisors Forbes

SHOOK Research | In Partnership with Forbes | SHOOK Research recognizes the most outstanding financial advisors in the business - each of who represent the. Five of our financial advisors have been named Forbes Best-In-State Wealth Advisors for Among those recognized are Chairman & CEO Steve Cassaday. Congratulations to these Forbes-recognized financial advisors · Troy Nelson · Bethany Abeln · Bryant Albi · Bob Allbright · Becky Anderson · Tyler Anderson. Top Advisor Rankings by State. Barron's published its first advisor ranking in to shine a spotlight on the nation's best wealth managers and raise. Join us in congratulating Magay on her third consecutive recognition being named to Forbes' America's Top Women Wealth Advisors List. Advisors who aren't juggling hundreds of clients are more likely to do real financial planning. Upvote. Congratulations to these Forbes-recognized financial advisors · Troy Nelson · Becky Anderson · Matt Armentrout · Frank Aswad · Michael Bishop · Al Biss · Heath Bowling. Glen D. Smith has been named as one of Forbes Best-in-State Wealth Advisors for , a prestigious recognition for standout wealth advisors who top the list. I'm proud to work on a team with two advisors who were recently named Best in State Advisors by Forbes. William Platt and Renato J Reali are. SHOOK Research | In Partnership with Forbes | SHOOK Research recognizes the most outstanding financial advisors in the business - each of who represent the. Five of our financial advisors have been named Forbes Best-In-State Wealth Advisors for Among those recognized are Chairman & CEO Steve Cassaday. Congratulations to these Forbes-recognized financial advisors · Troy Nelson · Bethany Abeln · Bryant Albi · Bob Allbright · Becky Anderson · Tyler Anderson. Top Advisor Rankings by State. Barron's published its first advisor ranking in to shine a spotlight on the nation's best wealth managers and raise. Join us in congratulating Magay on her third consecutive recognition being named to Forbes' America's Top Women Wealth Advisors List. Advisors who aren't juggling hundreds of clients are more likely to do real financial planning. Upvote. Congratulations to these Forbes-recognized financial advisors · Troy Nelson · Becky Anderson · Matt Armentrout · Frank Aswad · Michael Bishop · Al Biss · Heath Bowling. Glen D. Smith has been named as one of Forbes Best-in-State Wealth Advisors for , a prestigious recognition for standout wealth advisors who top the list. I'm proud to work on a team with two advisors who were recently named Best in State Advisors by Forbes. William Platt and Renato J Reali are.

The eligibility criteria for Forbes' list of America's Top Financial Advisors includes being a registered representative or investment advisor representative of. Congratulations to our advisors who were named to the Forbes Top Best-in-State Wealth Advisors rankings! A much-deserved recognition for these. Forbes | America's Top Wealth Advisors List (). Terry Cook, CFP®, CIMA® was ranked #62 in America for America's Top Wealth Advisors, issued on August September 26, FORBES recognized the Top Wealth Advisors in the United States. For the second year in a row Randy Carver was recognized on this prestigious. SHOOK proudly funds philanthropic research. Our goals: creating awareness, propagating best practices and raising money for the world of philanthropy. Thomas J. Bartholomew Honored in Barron's List of America's Top Financial Advisors for Barron's Top Advisors and , Forbes Best-In-State Wealth Advisors Tag · May 08, John Arensdorf Makes His Debut on the Forbes Best-In-State Wealth Advisors List, Ranking # in. I'm proud to work on a team with two advisors who were recently named Best in State Advisors by Forbes. William Platt and Renato J Reali are. We are proud to announce that Founder and CEO Hank McLarty has been named to the Forbes America's Top Wealth Advisors list for the ninth consecutive. Out of thousands of nominees, our very own Los Angeles financial planner was ranked by Forbes 54th out of top financial professionals nationwide. The Forbes' list of America's Top Financial Advisors covers various industry segments such as wealth management, investment banking, financial planning, estate. Congratulations to the Merrill advisors named to the Forbes “Top Next-Gen Wealth Advisors Best-in-State” list. We appreciate all you do to for our. Forbes Best-in-State Wealth Advisor: Awarded to Paul West (, ). Portfolio performance is not a criteria due to varying client objectives and lack of. Jason Bell, Joe Lum, and Andy Meyer named to the Forbes Next-Gen Wealth Advisor List in their respective states. advisors who were also named to Forbes' America's Top Wealth Advisors list. “We're honored to partner with some of the best financial advisors in the. Record-Setting J.P. Morgan Wealth Management Advisors Make Forbes' Best-in-State Wealth Advisors List · Frank Botta, Wealth Partner – Boston · Patrick Corbett. 61 Morgan Stanley Financial Advisors who made this year's Forbes “America's Top Wealth Advisors” list. Sandy has been listed as one of the top wealth advisors in the state by Forbes! This is the seventh annual ranking of Forbes/Shook Top Women Wealth Advisors. Randy Carver was among the advisors named to the Forbes list of Best-In-State Wealth Advisors. The list recognizes advisors from national, regional and. – In their sixth annual Best-In-State Wealth Advisors ranking, Forbes recognized Beacon Pointe Partner and Managing Director, Carrie Gallaway, CFP®, and.

How To Turn A Site Into An App

With our Swiftspeed web to app converter, you can effortlessly convert your website to an app that retains and amplifies the user engagement you've cultivated. Convert your site into a native mobile app for both Google Play and the Apple App Store!My Mobile App uses your website to create a stunning app. Converting a website to an app has never been this easy. We handle all the technical aspects of creating and publishing your app in the app stores. How to Turn Your Divi Site into a Mobile App with AppPresser · Step #1: Create a New App and Customize Its Style · Step #2: Change Your App's Menu · Step #3. Create your desktop app for free *. ToDesktop Builder will take you step-by-step through the process of creating your first desktop app in just a few minutes. 1. Add Wized to your Webflow project. Wized is a powerful no-code front end framework built specifically for Webflow. Wized allows you to connect your website. In this blog post, I'll discuss how expanding your digital foothold through an app benefits your business and how to set up web or mobile apps based on. Appful converts your website into apps with % native elements and revolutionary Design/UI using latest programming languages. There are really only two options that work well for migration from web app to mobile — developing a hybrid app or starting from scratch and building native. With our Swiftspeed web to app converter, you can effortlessly convert your website to an app that retains and amplifies the user engagement you've cultivated. Convert your site into a native mobile app for both Google Play and the Apple App Store!My Mobile App uses your website to create a stunning app. Converting a website to an app has never been this easy. We handle all the technical aspects of creating and publishing your app in the app stores. How to Turn Your Divi Site into a Mobile App with AppPresser · Step #1: Create a New App and Customize Its Style · Step #2: Change Your App's Menu · Step #3. Create your desktop app for free *. ToDesktop Builder will take you step-by-step through the process of creating your first desktop app in just a few minutes. 1. Add Wized to your Webflow project. Wized is a powerful no-code front end framework built specifically for Webflow. Wized allows you to connect your website. In this blog post, I'll discuss how expanding your digital foothold through an app benefits your business and how to set up web or mobile apps based on. Appful converts your website into apps with % native elements and revolutionary Design/UI using latest programming languages. There are really only two options that work well for migration from web app to mobile — developing a hybrid app or starting from scratch and building native.

Actually, there's no tool that can convert your website into a custom mobile app or vice versa. That's why you may need services of a web app development. Convert website into an app in just a few 88rajaslothoki.online app from website with free ads. Convert web 2 app fast with our help. Streamlit turns data scripts into shareable web apps in minutes. All in pure Python. No front‑end experience required. Try Streamlit nowDeploy on Community. Yes, using Shoutem mobile app builder you can quickly turn your Shopify store into an app. Best of all, templates and features are already pre-made, and no. Consider the mobile experience of a user's journey who is searching for a company, but that company hasn't converted its website into an. Transform your Notion pages into fully customized, professional websites in less than a minute. Enjoy high performance, SEO optimization, and a compelling user. Creating a Fluid App out of your favorite website is simple. Enter the website's URL, provide a name, and optionally choose an icon. Click "Create", and within. Our platform can convert any responsive website to an android and iOS mobile application for a quick launch from the stores. Progressive web apps are another alternative to traditional native and hybrid applications. It is a simple version of websites to convert into. Yes, with Twinr's Ecommerce Mobile App Builder, you can easily convert your existing ecommerce website into a mobile app. Our platform allows you to create a. First you learn programming (try Teach Yourself Computer Science). Then you learn JavaScript (for the code that will run in a web browser, if the target is a. In this article, we will look at different approaches to converting a website into an app. But first, why should you go through this process? Download WebViewGold and turn your website or web app into an Android & iOS app easily. You can also contact our professionals to convert your website into. Open Google Chrome. · Mouse over to the left area of Google Chrome. · Click on the icon that says “Apps”. · Navigate to the web app icon that you created. · Right. Turn your website into an Android app in seconds. It's free! · ☁. Convert the most complex web application or website to an Android app on the fly · ⟳. Enjoy. You can open and use a website as if it's an app. A Safari window showing the Confluence website as a web app, with a Confluence menu bar and a Confluence icon. 1. Add Wized to your Webflow project. Wized is a powerful no-code front end framework built specifically for Webflow. Wized allows you to connect your website. Turn your website into an Android app in seconds. It's free! · ☁. Convert the most complex web application or website to an Android app on the fly · ⟳. Enjoy. Learn to turn ANY website into a Chrome web app with this free tool. Thus in Chrome turn website into app for free, quickly and relatively easily. Convert your site into a native mobile app for both Google Play and the Apple App Store!My Mobile App uses your website to create a stunning app.

Refinancing And Consolidating Student Loans

There are two primary vehicles to refinance your federal student loans: 1) via a Federal Direct Consolidation loan or 2) via a private lender. How does the. When deciding on different payment options, many students consider loan consolidation or refinancing. Loan consolidation and refinancing gives students the. Student loan refinancing is when you combine all your student loans with a private lender and receive a lower interest rate and different repayment terms. On. You can consolidate both your federal and private student loans together with a private lender such as a bank or credit union. In doing so, you'd lose your. You repay a Federal Consolidation Loan to the U.S. Department of Education. Federal Consolidation Loans are made through the Federal Family Education Loan (FFEL). Refinancing lets you trade in your high-rate student debt for one low-rate loan with a single monthly payment. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. Student loan consolidation most often refers to the federal program. Student loan refinancing usually refers to programs offered by private lenders. What is. With a Direct Consolidation Loan, you can only consolidate your federal student loans, not private, and your new interest rate will not decrease. Your new rate. There are two primary vehicles to refinance your federal student loans: 1) via a Federal Direct Consolidation loan or 2) via a private lender. How does the. When deciding on different payment options, many students consider loan consolidation or refinancing. Loan consolidation and refinancing gives students the. Student loan refinancing is when you combine all your student loans with a private lender and receive a lower interest rate and different repayment terms. On. You can consolidate both your federal and private student loans together with a private lender such as a bank or credit union. In doing so, you'd lose your. You repay a Federal Consolidation Loan to the U.S. Department of Education. Federal Consolidation Loans are made through the Federal Family Education Loan (FFEL). Refinancing lets you trade in your high-rate student debt for one low-rate loan with a single monthly payment. Refinancing your existing student loans allows you to combine multiple loans into a single loan, making payments more manageable. Student loan consolidation most often refers to the federal program. Student loan refinancing usually refers to programs offered by private lenders. What is. With a Direct Consolidation Loan, you can only consolidate your federal student loans, not private, and your new interest rate will not decrease. Your new rate.

While there are similarities between student loan consolidation and student loan refinancing, they are different programs with unique features. Although the U.S. Department of Education permits student loan consolidation with Direct Consolidation Loans, it doesn't allow borrowers to refinance their debt. Splash marketplace loans offer fixed rates between % APR to % APR (without autopay) and terms of 2 to 7 years. Personal loans offered through the. Refinancing your existing student loans into one consolidated loan can help ease your monthly payments and save you money. By consolidating your existing. There are two primary vehicles to refinance your federal student loans: 1) via a Federal Direct Consolidation loan or 2) via a private lender. How does the. Refinancing or consolidating your student loans can be a great way to lower your interest rate and decrease your monthly payments. There are two basic ways to consolidate your student loans. You can do so either through a private lender or the federal government. You could save money by refinancing student loans and consolidating debt. Get your student loan refinance rate online in 2 minutes. When you refinance your student loans with College Ave, you can choose a brand new loan term between 5 and 20 years. A longer loan term can help to lower your. Though both refinance and direct consolidation can combine existing student loan debt into a single loan, there are some significant differences. Consolidation and refinancing both combine or replace existing student loans into a single new loan. The details of how each work are different. Interest rates for student loan refinancing stayed about the same as last month, according to a US News analysis of minimum and maximum APRs reported by. The answer is no. While consolidations and refinancing can reduce the number of loans you have to manage, they are not the same thing. The process involves combining private student loans into a single loan, often with a new lender. This simplifies your finances by replacing multiple loans with. Consolidation is similar to refinancing a loan. In both cases, you are taking out a new loan that pays off your existing loans. But consolidation is less risky. Savings vary based on rate and term of your existing and refinanced loan(s). Refinancing to a longer term may lower your monthly payments, but may also increase. Let's look at what it means to refinance private and federal student loans, what to consider, and how to start the refinancing process. How to Refinance Student Loans in Five Steps · 1. Compile a list of your current student loans, their balances, and interest rates. · 2. Explore current. You may be eligible if you meet certain requirements such as: You have at least $10, in student loans to refinance, which can include private student loans. Refinancing could help you pay off your student loan sooner or bring down your monthly payment amount—all on your terms.

Get Free Money On Chime

CHIME can earn free money every time you buy groceries IF your club cards and other cards are registered! IT COSTS YOU NOTHING! Register with Ralphs for Free. Money transfer: A Venmo-like fee-free facility to send or receive money from Chime/non-Chime bank account holders. In , Chime has announced that it will. Chime Deals is a fee-free feature for Chime members to get cash back on everyday purchases through in-app deals. Multiple Methods: Chime supports various methods for receiving money, including direct transfers from other banks, Chime's Pay Anyone feature. Set up direct deposit of your paycheck to your Chime online checking account to access the free Get Paid Early feature. get your money up to two days ahead of. If you're thinking of getting Chime why not use a referral code and get free money. When i joined i only got $ I wish i could rejoin and. If you are a newer chime account and haven't done the bonus yet, free money for both of us! Join me on Chime and we'll each get $ There's a totally fee free option. that you get access to in one to two days, usually in 24 hours. And then we also have an option you can get it instantly for. Chime Savings earns a yield of %³; not the highest available from the best online banks, but still well above the national average. Like Chime Checking. CHIME can earn free money every time you buy groceries IF your club cards and other cards are registered! IT COSTS YOU NOTHING! Register with Ralphs for Free. Money transfer: A Venmo-like fee-free facility to send or receive money from Chime/non-Chime bank account holders. In , Chime has announced that it will. Chime Deals is a fee-free feature for Chime members to get cash back on everyday purchases through in-app deals. Multiple Methods: Chime supports various methods for receiving money, including direct transfers from other banks, Chime's Pay Anyone feature. Set up direct deposit of your paycheck to your Chime online checking account to access the free Get Paid Early feature. get your money up to two days ahead of. If you're thinking of getting Chime why not use a referral code and get free money. When i joined i only got $ I wish i could rejoin and. If you are a newer chime account and haven't done the bonus yet, free money for both of us! Join me on Chime and we'll each get $ There's a totally fee free option. that you get access to in one to two days, usually in 24 hours. And then we also have an option you can get it instantly for. Chime Savings earns a yield of %³; not the highest available from the best online banks, but still well above the national average. Like Chime Checking.

EARN $50 BONUS JUST FOR SIGNING UP! Sign up for Chime, the free and no fee online bank. It only takes a few minutes and you will have your account ready to go! Chime is a free online bank that offers a $ referral bonus if you open a new Chime account using a referral link. To earn the $ referral bonus. Option to get funds instantly for $2 per advance or get funds for free within 2 days. The Chime Visa® Debit Card and the Chime Credit Builder Visa. Chime makes money primarily by collecting a portion of something called an interchange fee. An interchange fee (also called a swipe fee) is a fee that's. Find the latest Chime® promo codes, coupons & deals for August - plus earn $ Cash Back at Rakuten. Join now for a free $10 Welcome Bonus. Takes 4 mins · Earn $5 ( Points) after successfully signing up for a for a Chime Card. · Click on the "Get Started" or "Open an Account" button to begin. Chime makes money primarily by collecting a portion of something called an interchange fee. An interchange fee (also called a swipe fee) is a fee that's. Chime is one of the best online mobile banks; they pay you a $ bonus when you open a Chime Spending Account and establish a $ direct deposit. Join other Chime members in earning free cash and gift cards on InboxDollars. · InboxDollars is the simple, fun way to earn cash and free gift cards. · How It. Securely Pay Anyone through Chime in seconds – all they need is a valid debit card to claim their cash. No sign-up needed! Fee-free instant transfers. Chime earn $ after receiving direct deposit of !Signing up takes only 2 minutes Sign up with my link: 88rajaslothoki.online We'll. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Chime's referral bonus program is a simple way to earn money by referring others to join. When you refer a friend and they (a) join Chime and (b) receive a. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. Chime is a free online bank that offers a $75 referral bonus if you open a new Chime account using a referral link. To earn the $75 referral. Now, here's where things get really exciting. With Chime, you can turn your spare time into cold, hard cash just by referring your friends. Are you looking to make some extra cash without much effort? Look no further! Chime, a popular online bank, is offering a fantastic. Chime is the most loved banking app. Get paid when you say with MyPay, overdraft fee-free with SpotMe, and improve your credit with Credit Builder. Chime offers $ cash for every friend you successfully refer. You can refer as many as you want, but there is a maximum of $1, referral bonuses per year.

How Do You Trade In A Vehicle You Owe On

When you trade in a financed vehicle, the dealer might roll the old loan's balance into the loan for your new vehicle, if that amount is greater than the value. You can trade in your car to a dealership even if you still owe money on it, but this can be a costly decision if you have negative equity. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. Yes, it's absolutely possible to trade in your car even if you still owe money on the loan. However, you should keep in mind that you'll still have to pay off. You'll simply have to come up with the difference in cash up front or you may have the option to roll it into a new loan on your new car. For situations where. Either you pay the difference between what you owe and what the car is worth, or the dealer will take over your loan, but roll your negative equity into the. Yes, the balance owed still is deducted from trade-in applied toward new vehicle. Say your Acura is worth $20k and you owe $ This means if the trade-in value of the vehicle is less than the loan amount you owe, you would owe the dealership money to cover the difference. At Credit. Yes you can. It does not affect the value. The dealership will add the remaining balance to the price quote. They will pay the loan off after. When you trade in a financed vehicle, the dealer might roll the old loan's balance into the loan for your new vehicle, if that amount is greater than the value. You can trade in your car to a dealership even if you still owe money on it, but this can be a costly decision if you have negative equity. The answer is yes! However, the loan on your current vehicle won't go away because you've traded it in; you'll still have to pay off the balance. Yes, it's absolutely possible to trade in your car even if you still owe money on the loan. However, you should keep in mind that you'll still have to pay off. You'll simply have to come up with the difference in cash up front or you may have the option to roll it into a new loan on your new car. For situations where. Either you pay the difference between what you owe and what the car is worth, or the dealer will take over your loan, but roll your negative equity into the. Yes, the balance owed still is deducted from trade-in applied toward new vehicle. Say your Acura is worth $20k and you owe $ This means if the trade-in value of the vehicle is less than the loan amount you owe, you would owe the dealership money to cover the difference. At Credit. Yes you can. It does not affect the value. The dealership will add the remaining balance to the price quote. They will pay the loan off after.

If you can hold off on buying a new vehicle, you can reduce your negative equity by making extra payments on the car loan. Delaying a trade-in is often the best. If you're upside down on your car loan, you can consolidate what's owed on your current car with the price of your new ride. Value Your Trade-In: FAQs. Q: Can. Some dealerships allow you to trade in an upside down car. However, beware – while the dealer agrees to pay for the loan upfront, the existing balance is added. It is never a good idea to trade in a car that you owe money on. Even if you want to buy a cheaper car, you still pay tax and license and other. Trading in a car with a loan you still owe on is possible, but is it right for you? Keep these tips in mind when trading in for a new vehicle. If you have positive equity on the car (as in it's worth more than what you currently owe), you can trade it in easily. The dealer will purchase the car and pay. Either way, be sure to verify that the dealership has paid off your current loan within 10 days to avoid your lender thinking you've lapsed on your car payments. Q: Can you trade in a financed car? A: Yes, you can. If you have positive equity on the car (as in it's worth more than what you currently owe), you. Humble often want to know, "Can you trade in a financed car?" The answer is yes! However, keep in mind that trading your car in does not mean that you're no. Absolutely — but just because you're trading it in doesn't mean that the loan on your vehicle disappears. You will still be required to pay off the balance. A common question we encounter is "will a dealership buy my car if I still owe?" It is definitely possible to trade in even if you are still paying your auto. Adding Negative Equity to a New Loan: The dealer adds the remaining loan amount to your new car loan. For example, if you owe $10, on your current car but. You'll often find that when trading in a financed car, the value of your trade-in will be enough to pay off whatever remains on your loan. For example, if you. Can I Trade In a Car With Negative Equity? If you're interested in trading in your upside-down car, some dealerships will offer to pay off the loan for you. You can do this by trading in your current vehicle and getting a new auto loan that includes your negative equity. This means you'll start off upside-down on. You can trade in your car for a new one even if you still have a loan on it. But that can be costly if you owe more than your trade-in is worth. If the amount you owe is less than the trade-in value, then you'll simply be transferring ownership to the car dealer. If you owe more on the loan than what the. Can You Trade in a Financed Car? Yes, you can trade in a financed car, but you still have to pay off the remaining loan balance. However, this is not as. You can trade in your car for a new one even if you still have a loan on it. But that can be costly if you owe more than your trade-in is worth. When your car is worth more than what's owed, you have positive equity. If you owe $6, on your car and its trade-in value is $8,, you have $2, in.

How To Start Index Funds

The first step to investing in index funds is to open and set up your brokerage account. Look for one that offers commission-free trading and many different. An index fund is a group of investments that you invest in, which will allow you to own a small percentage of each of the investments. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Determine Your Investment Goals · Choose the Right Index Fund · Gather the Necessary Documents · Open an Account with Fidelity · Fund Your Account · Set Up Your. Deciding which type of fund to buy doesn't need to be an either-or proposition. Many investors use a mix of index funds and actively managed funds in their. You can invest in index funds via a wide range of ETFs, REITs, ETCs and investment trusts if you have an account with us. Here are steps on how to buy index. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Some index funds provide exposure to thousands of securities in a single fund, which helps lower your overall risk through broad diversification. By investing. The first step to investing in index funds is to open and set up your brokerage account. Look for one that offers commission-free trading and many different. An index fund is a group of investments that you invest in, which will allow you to own a small percentage of each of the investments. An index fund is an investment fund – either a mutual fund or an exchange-traded fund (ETF) – that is based on a preset basket of stocks, or index. Determine Your Investment Goals · Choose the Right Index Fund · Gather the Necessary Documents · Open an Account with Fidelity · Fund Your Account · Set Up Your. Deciding which type of fund to buy doesn't need to be an either-or proposition. Many investors use a mix of index funds and actively managed funds in their. You can invest in index funds via a wide range of ETFs, REITs, ETCs and investment trusts if you have an account with us. Here are steps on how to buy index. An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or "index," like the popular S&P Index—as closely. An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Some index funds provide exposure to thousands of securities in a single fund, which helps lower your overall risk through broad diversification. By investing.

One can invest in index funds in the same manner as any other mutual fund scheme, wherein the transactions happen through mutual fund house. The mutual funds. All About Index Funds: The Easy Way to Get Started (All About Series) [Ferri, Richard A.] on 88rajaslothoki.online *FREE* shipping on qualifying offers. You can buy and sell index funds by opening an investment account. If you open an investment account with a bank, credit union or another financial institution. Indexing is such an easy choice.. Almost any random selection of stocks is likely to beat an index fund, long-term – indexing overweights the largest, safest. Index investing, sometimes referred to as passive investing, is typically done by investing in a mutual fund or exchange-traded fund (ETF) that aims to. Find latest pricing, performance, portfolio and fund documents for Franklin S&P Index Fund - SBSPX. An index fund is an investment that tracks a market index (eg S&P ). They aim to track the performance of the index and deliver the same return. So if the. Index investing is a passive investment method achieved by investing in an index fund. An index fund is a fund that seeks to generate returns from the broader. If a fund or ETF doesn't offer the potential to outperform an index or benchmark, cost becomes more important when selecting investment options. When evaluating. These funds provide access to a wide variety of investable markets; however, an index fund might not include a company you like or believe will perform well as. When you put money in an index fund, that cash is then used to invest in all the companies that make up the particular index, which gives you a more diverse. Fidelity and Vanguard are arguably the best brokerages for mutual fund index funds. Each of these brokerages has its own family of mutual funds that you can. Some index funds provide exposure to thousands of securities in a single fund, which helps lower your overall risk through broad diversification. By investing. Both include a pool of many different stocks and offer a way to diversify and protect your investments. In fact, most index funds are a type of mutual fund. Index funds have been around since John Bogle introduced the Vanguard Index Fund as the inaugural retail index fund back in His goal was to offer low-. Fidelity and Vanguard are arguably the best brokerages for mutual fund index funds. Each of these brokerages has its own family of mutual funds that you can. How to invest in the S&P Index · 1. Open a brokerage account · 2. Choose between mutual funds or ETFs · 3. Pick your favorite S&P fund · 4. Enter your trade. To buy index funds, consider buying an ETF index fund if you don't have a lot of capital to start with since they're cheap to buy into and generally have good. The goal of an index fund isnt to beat the market, but rather reflect the ongoing state of the market. Because theyre passively managed (as opposed to actively. Vanguard Index Fund Admiral Shares (VFIAX) · Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) · iShares MSCI World ETF (URTH) · BNY Mellon U.S.

Chevy Silverado 1500 Turbo Diesel

The new Chevy Silverado Diesel Engine is here on sale at Laura Chevrolet Wielding a L Turbo Diesel 6-Cylinder hp engine on our LD. The L Duramax® turbo diesel engine churns out pound-feet of torque and over horsepower, while still getting up to 29 MPG on the highway. A new. Chevrolet Silverado RST Z71 Duramax Diesel ; MSRP $63, ; Savings: $11, ; Unconditional Retail Price*: $52, Duramax® L Turbo-diesel I hp; lb-ft of torque. Chevy Silverado Engine Specs: Base Engine: L EcoTec3 V6 Engine with hp and lb. Without the option of the turbo-diesel, I probably wouldn't consider a Silverado but now my mind has been changed, this motor is absolutely brilliant. Chevy has. Used Diesel Chevrolet Silverado for sale on 88rajaslothoki.online Search used cars, research vehicle models, and compare cars, all online at 88rajaslothoki.online Used Diesel Chevrolet Silverado for sale ; White Chevrolet Silverado RST · $49,*6K mi6, miles. Free Shipping | Est. arrival 9//11 CarMax. The new Chevy Silverado Diesel Engine is here for sale at Bob Wielding a L Turbo Diesel 6-Cylinder hp engine on our LD Silverado. The new Chevy Silverado is a full-size lightweight pickup truck complete with a Duramax Turbodiesel engine. The new Chevy Silverado Diesel Engine is here on sale at Laura Chevrolet Wielding a L Turbo Diesel 6-Cylinder hp engine on our LD. The L Duramax® turbo diesel engine churns out pound-feet of torque and over horsepower, while still getting up to 29 MPG on the highway. A new. Chevrolet Silverado RST Z71 Duramax Diesel ; MSRP $63, ; Savings: $11, ; Unconditional Retail Price*: $52, Duramax® L Turbo-diesel I hp; lb-ft of torque. Chevy Silverado Engine Specs: Base Engine: L EcoTec3 V6 Engine with hp and lb. Without the option of the turbo-diesel, I probably wouldn't consider a Silverado but now my mind has been changed, this motor is absolutely brilliant. Chevy has. Used Diesel Chevrolet Silverado for sale on 88rajaslothoki.online Search used cars, research vehicle models, and compare cars, all online at 88rajaslothoki.online Used Diesel Chevrolet Silverado for sale ; White Chevrolet Silverado RST · $49,*6K mi6, miles. Free Shipping | Est. arrival 9//11 CarMax. The new Chevy Silverado Diesel Engine is here for sale at Bob Wielding a L Turbo Diesel 6-Cylinder hp engine on our LD Silverado. The new Chevy Silverado is a full-size lightweight pickup truck complete with a Duramax Turbodiesel engine.

Requires Silverado Double Cab Standard Bed 2WD or Crew Cab Short Bed 2WD with available Duramax L Turbo-Diesel engine, Max Trailering Package and inch. The new Chevy Silverado Diesel Engine is here on sale at Hardin Chevrolet Powered by a L Turbo Diesel 6-Cylinder hp engine on the. Electronically controlled with overdrive. L Duramax Turbo-Diesel I6 Engine: hp; lb-ft of torque; Paired with a speed. The new Chevy Silverado Diesel Engine is here on sale at Laura Chevrolet Wielding a L Turbo Diesel 6-Cylinder hp engine on our LD. Get available best-in-class fuel economy for your Tahoe or Suburban,† or add more range to your Silverado,† with an available advanced L Turbo-Diesel engine. View towing capacity by engine in the following table. Engine, L TurboMax I4, L EcoTec3 V8, L EcoTec3 V8, L Duramax turbo diesel I6. The Chevrolet Silverado is a range of trucks manufactured by General Motors under the Chevrolet brand. Introduced for the model year, the Silverado is. Chevy also offers a turbodiesel engine for the Silverado, which is significant because both the Ford F and Ram no longer do. The diesel engine is. TurboMax. Boasting horsepower and a maximum of lb. · L EcoTec3 V8 · L ECOTEC3 V8 · Duramax L Turbo-Diesel Engine · Sherman Chevrolet is your one-. The L Duramax® turbo diesel engine churns out pound-feet of torque and over horsepower, while still getting up to 29 MPG on the highway. A new. With the Silverado Duramax's unparalleled 33 mpg highway fuel mileage (on rear-wheel-drive models) you can own the highway without the gas pumps eating. I found it annoying owning a home and not having a truck (home Depot trips were annoying AF with a small BMW x1). I didn't consider a Diesel. Shop our inventory of Chevy Silverado diesel trucks for sale in Dothan, Alabama. Visit Solomon Chevrolet to test drive a new pickup today. See how the towing capabilities compare in the following table. Engine, L TurboMax I4, L EcoTec3 V8, L EcoTec3 V8, L Duramax turbo diesel I6. The new Chevy Silverado Duramax is on sale in PITTSBURGH with us at North Star Chevrolet - West Liberty and you'll want to witness this industry. Test drive Used Chevrolet Silverado at home from the top dealers in your area. Search from Used Chevrolet Silverado cars for sale. This unique engine is offered on three Chevy vehicles, the Chevy Silverado , Chevy Tahoe, and Chevy Suburban. Liter DuraMax Turbo-Diesel Inline-Six. Chevy Silverado torque reaches its highest point here: an output of pound-feet, complemented by low-RPM. Chevy also offers a turbodiesel engine for the Silverado This truck is a Silverado Crew Cab LTZ with the new L Duramax Diesel engine. Get the best deal for Turbo Chargers & Parts for Chevrolet Silverado from the largest online selection at 88rajaslothoki.online | Browse our daily deals for even.

What Are The Best Workout Apps

The 10 Best Fitness Apps of · Best Fitness App Overall: Future · Best Fitness App for Personal Training: Caliber · Best Fitness App for Live Classes: iFIT. A more empowered you starts with Sweat · It feels good to Sweat. · Ready to try a workout? · Discover just how good it feels to Sweat · Nobody knows Sweat like we. Other apps I found good are Strong, JeFit, FitNotes and Boostcamp. P.S. - The main reason i use hevy is because of it discover feed which makes. Fitness Apps for Teens. Blogilates Users can configure their ideal exercise duration and workout goals, and the app will whip up a workout session for. “I've tried many fitness apps and so far FitnessAI is easily the best in terms of an easy to use interface and automatically optimizing workouts. I highly. Home Workout - No Equipments. by Very Useful Apps · ; Daily Workouts - Fitness Coach. by Daily Workout Apps, LLC · ; Peloton. by Peloton Interactive, Inc. Explore top iPhone Health & Fitness apps on the App Store, like Yuka - Food & Cosmetic Scanner, 75 Hard, and more. Centr Unleashed is a bodyweight workout program that gives you the freedom to train anywhere – no equipment required. Over six weeks, trainers Luke Zocchi. The 7 Best Workout Apps for At Home and On the Road · 1. Nike Training · 2. SWEAT App · 3. FitnessBlender · 4. Beachbody On Demand · 5. Magic Fitness · 6. Yoga. The 10 Best Fitness Apps of · Best Fitness App Overall: Future · Best Fitness App for Personal Training: Caliber · Best Fitness App for Live Classes: iFIT. A more empowered you starts with Sweat · It feels good to Sweat. · Ready to try a workout? · Discover just how good it feels to Sweat · Nobody knows Sweat like we. Other apps I found good are Strong, JeFit, FitNotes and Boostcamp. P.S. - The main reason i use hevy is because of it discover feed which makes. Fitness Apps for Teens. Blogilates Users can configure their ideal exercise duration and workout goals, and the app will whip up a workout session for. “I've tried many fitness apps and so far FitnessAI is easily the best in terms of an easy to use interface and automatically optimizing workouts. I highly. Home Workout - No Equipments. by Very Useful Apps · ; Daily Workouts - Fitness Coach. by Daily Workout Apps, LLC · ; Peloton. by Peloton Interactive, Inc. Explore top iPhone Health & Fitness apps on the App Store, like Yuka - Food & Cosmetic Scanner, 75 Hard, and more. Centr Unleashed is a bodyweight workout program that gives you the freedom to train anywhere – no equipment required. Over six weeks, trainers Luke Zocchi. The 7 Best Workout Apps for At Home and On the Road · 1. Nike Training · 2. SWEAT App · 3. FitnessBlender · 4. Beachbody On Demand · 5. Magic Fitness · 6. Yoga.

What are the Best Free Fitness Apps in ? This year I asked a personal trainer. NO AFFILIATE LINKS are in this video for best free. Once you have your mind set on what you're looking for, you'll have an easier time finding the perfect app to fit your needs. Remember to take advantage of. Find your perfect pace with an App membership · Strength. Preview strength classes · Cycling. Preview cycling classes · Yoga. Preview yoga classes · Running. We've compiled a list of the workout apps currently topping the Google Health & Fitness chart (at the time of writing) in Australia. I've been using Gymshark Training both on Android and iphone. It was great, lots of workout plans based on equipment, time, which part of the. In this blog post, we'll explore the top 15+ features that can propel your fitness app to popularity and make it a go-to choice for fitness enthusiasts. No equipment needed— unlimited access on any screen. UNLIMITED VARIETY. Get access to world's best workouts from cardio, yoga, strength. M posts. Discover videos related to Best Workout Apps on TikTok. The PF App is a gym in your pocket. With free workout and exercise tutorials, progress tracking and more, discover the best fitness app for you! Find and save ideas about best fitness apps for women on Pinterest. 'Trybe' is a really good app. Its free, mostly involves body weight workout with minimal equipment, and gives the option to start as beginner. BETTER POINTS · Just dance now app screenshot · Fitness RPG app screenshot · Stand up app screenshot · one you couch to 5k app · Daily fitness workout app · Adidas. Fitness App: Home Workout · Nike Training club · Runtastic · MyFitnessPal · Map My Run · Home Workout - No Equipments · JEFIT Workout Planner. Top Pick - Boostcamp: 88rajaslothoki.online #2 - Hevy: 88rajaslothoki.online #3 - Strong App: 88rajaslothoki.online #4. Move now! A better me is approaching! Get fit with the women workout - female fitness app! Sweat 7 mins a day to get a perfect bikini body! Looking to build muscle and lose weight? Home Workout has got you covered! No equipment needed, easy to follow at home. Follow the tailored plans and expert. From the unique programming, coach engagement, the ladder community, it is one of the best fitness apps I've tried. The best workout app out there! What is the Best Workout Music App? · 1. RockMyRun. True to its name, RockMyRun is one of the top music workout apps available. · 2. Perform. Perform matches. BodyFit by 88rajaslothoki.online—Gym Workouts & Strength Training Plans. I selected the objective specifically for “muscle building”. The app then gave me several. Best Free Workout Apps. C25K (iOS, Android). If you want to run but don't know where to start, this app is it. Short for Couch to 5K, the C25K.

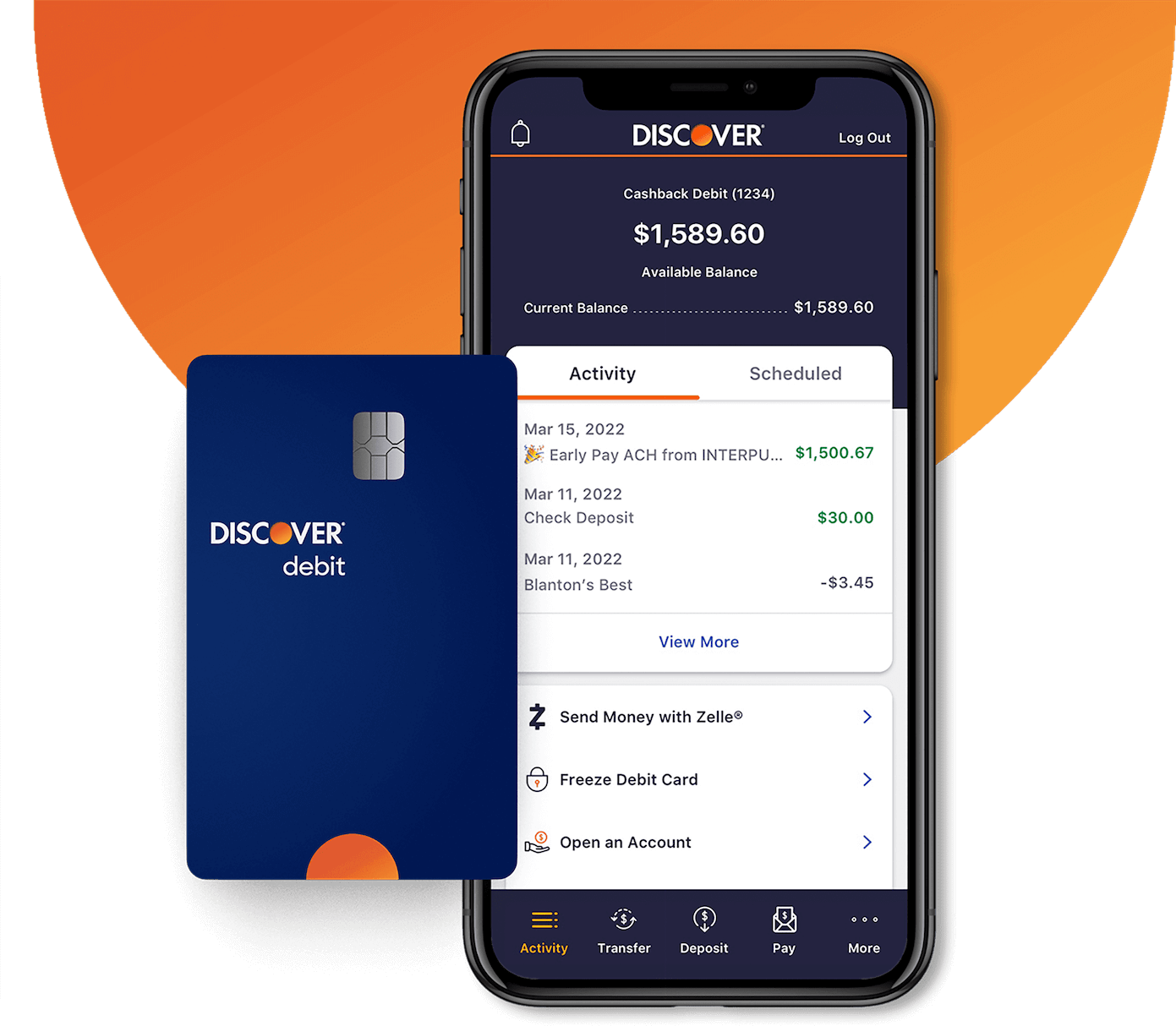

Discover Bank Debit Card Cash Back

The Discover debit card pays a 1% cashback benefit on up to $3, in debit card purchases each and every month, allowing you to earn money just by using cash. Family Dollar charges a $1 fee for getting cash back from Discover and debit cards. The Discover Cashback Debit Account provides you with an easy way to earn rewards on debit card purchases that can earn you up to $ in cash back every year. Endorsed by the American Bankers Association, Discover® Debit offers flexibility to meet your needs with simple rules, transparent fees, the security of early-. You may earn 1% cash back on up to $3, in debit card purchases each month*. That's up to $ each year! * See Deposit Account Agreement for details on. Key Takeaways · Up to 1% cash back. Discover® Cashback Debit Checking Account offers rewards on purchases (see terms and conditions here for full details). · 0%. Discover Bank's Cashback Debit account, which is highly rated by Bankrate, pays 1 percent cash back on up to $3, in monthly debit card purchases. That's up to $75 cash back each quarter! Plus, you always earn Cashback Bonus when you use your Discover card on purchases. Need Help? See our FAQs. PROGRAM. “Discover Bank is an online bank providing one of the most attractive checking account offers in the industry. With it you can earn cash back on debit card. The Discover debit card pays a 1% cashback benefit on up to $3, in debit card purchases each and every month, allowing you to earn money just by using cash. Family Dollar charges a $1 fee for getting cash back from Discover and debit cards. The Discover Cashback Debit Account provides you with an easy way to earn rewards on debit card purchases that can earn you up to $ in cash back every year. Endorsed by the American Bankers Association, Discover® Debit offers flexibility to meet your needs with simple rules, transparent fees, the security of early-. You may earn 1% cash back on up to $3, in debit card purchases each month*. That's up to $ each year! * See Deposit Account Agreement for details on. Key Takeaways · Up to 1% cash back. Discover® Cashback Debit Checking Account offers rewards on purchases (see terms and conditions here for full details). · 0%. Discover Bank's Cashback Debit account, which is highly rated by Bankrate, pays 1 percent cash back on up to $3, in monthly debit card purchases. That's up to $75 cash back each quarter! Plus, you always earn Cashback Bonus when you use your Discover card on purchases. Need Help? See our FAQs. PROGRAM. “Discover Bank is an online bank providing one of the most attractive checking account offers in the industry. With it you can earn cash back on debit card.

That means you won't be charged an account fee on Discover Cashback Debit account. This includes Insufficient funds and Stop payment order. Earn 1% cash back on. Discover® Cashback Checking is free to open and one of the few online checking accounts that offer cash back rewards. Although these are not particularly. Just use your Discover Card at checkout and choose the amount of cash you would like to receive when prompted on the merchant terminal. Cash at checkout. When you open your checking account, you'll be sent a debit card that you can then use to earn 1% cash back on all debit card purchases, up to $30 per month. Take your money further with the right account. From cash back on debit card purchases to % APY Annual Percentage Yield (APY). Advertised Online Savings. The discover cash back checking account can be beneficial if you cannot use a credit card. Credit card rewards are above 1% which is above the. At the ATM back of your card. At Banks or Credit Unions. Simply show your card and photo ID when you request cash from the bank or credit union teller. How does the 5% Cashback Bonus program work? INTRO OFFER: Unlimited Cashback Match for all new cardmembers–only from Discover. · Earn 5% cash back on everyday purchases at different places you shop each. Discover Commercials · "Double Coffee" Discover it® Card Cashback Match Commercial - featuring Jennifer Coolidge · "Airhorn" Discover® Cashback Debit The Discover debit card pays a 1% cashback benefit on up to $3, in debit card purchases each and every month, allowing you to earn money just by using cash. Yes. You will continue to earn 1% cash back on up to $3, in debit card purchases each month* when you use Apple Pay with your Cashback Debit card. However. Open a Discover Cashback Debit account and start earning 1% cash back on up to $3, in debit card purchases each month**. You'll also get benefits like. The Discover Cash Back Debit Account puts a twist on traditional checking by offering 1% cash back on up to $3, in debit card purchases monthly. There's. Discover Bank customers with a checking account can earn 1% cash back on up to $3, monthly in purchases using their debit card, for a maximum of $30 back. Earn 1% cashback on debit card purchases. The account also features a debit card that earns you cashback, to the tune of 1% on all purchases, up to $3, per. ² When you redeem Cashback Bonus for an 88rajaslothoki.online Gift Card on 88rajaslothoki.online or in the Discover mobile app, you get 5% added value. Miles cannot be redeemed for. The Discover Cashback Debit account is straightforward, paying you back 1% on debit card purchases, up to $3, per month — so if you spend the maximum each. A major feature of the Discover Checking Account is its cash-back debit card. The 1% cash-back reward strictly applies to purchases, though. ATM. Choose which category you want to earn 3% cash back in: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming;.

Banks That Insure Millions

First off that $ , isn't a limitation. If you want a million in savings accounts or money markets you can open accounts in 4 different. Why is FDIC insurance important? The Federal Deposit Insurance Corporation (FDIC) exists to protect depositors' money held in banks. Its insurance limit. Your funds can be eligible for multi-million-dollar FDIC insurance at IntraFi network banks beyond the standard $, coverage - through ICS and CDARS. The standard deposit insurance amount is $, per depositor, per ownership category, at an insured bank. Does the amount of FDIC insurance coverage vary. Clients with accounts that are eligible for RJBDP can receive combined FDIC insurance of up to $3 million ($6 million for joint accounts)1. Combined FDIC. Secured by the FDIC Insure balances up to $2 million per tax ID, for free. We do the work in the background and you continue to access and manage all your. By using multiple banks versus a single bank, the program is able to provide up to $5 million of FDIC insurance ($10 million for joint accounts with two or more. Today's standard limit on FDIC insurance coverage is set at $, per depositor, per insured bank, for each account ownership category.1 By opening different. Your deposits are automatically insured to at least $, at each FDIC-insured bank. Vea esta página en español · Learn How Deposit Insurance Works. First off that $ , isn't a limitation. If you want a million in savings accounts or money markets you can open accounts in 4 different. Why is FDIC insurance important? The Federal Deposit Insurance Corporation (FDIC) exists to protect depositors' money held in banks. Its insurance limit. Your funds can be eligible for multi-million-dollar FDIC insurance at IntraFi network banks beyond the standard $, coverage - through ICS and CDARS. The standard deposit insurance amount is $, per depositor, per ownership category, at an insured bank. Does the amount of FDIC insurance coverage vary. Clients with accounts that are eligible for RJBDP can receive combined FDIC insurance of up to $3 million ($6 million for joint accounts)1. Combined FDIC. Secured by the FDIC Insure balances up to $2 million per tax ID, for free. We do the work in the background and you continue to access and manage all your. By using multiple banks versus a single bank, the program is able to provide up to $5 million of FDIC insurance ($10 million for joint accounts with two or more. Today's standard limit on FDIC insurance coverage is set at $, per depositor, per insured bank, for each account ownership category.1 By opening different. Your deposits are automatically insured to at least $, at each FDIC-insured bank. Vea esta página en español · Learn How Deposit Insurance Works.

In general, the FDIC (banks) and NCUA (credit unions) provide depositors with $, in coverage for their individual deposit accounts. Insured accounts. The FDIC insures $, per depositor, per insured bank, for each category of account ownership. There will be separate coverage for deposits. Wintrust's unique model allows us to offer something you won't find elsewhere: MaxSafe increases the amount of FDIC insurance coverage to $ million. In the wake of the bank failures, some banks now offer customers more FDIC insurance than the standard $,—up to $2 million in some cases with bank. With ICS® and CDARS® services, you can enjoy the safety and simplicity that comes with access to multi-million-dollar FDIC insurance through a single bank. Equal Housing Lender. Fifth Third Private Bank is a division of Fifth Third Bank, National Association offering banking, investment and insurance products and. But their uninvested cash can earn income through the firm's insured deposit program or money market funds. Citigold® Private Client. Clients: Clients. Deposits are FDIC insured up to $3,, per depositor through Coastal Community Bank, Member FDIC and our program banks. This insurance covers bank deposits held in checking accounts, savings accounts, certificates of deposits and money market deposits (not money market mutual. Federal and state government agencies insure investor deposits at partner banks, up to a certain amount. The FDIC insures up to $, per depositor per FDIC-insured bank. In the nearly year history of the FDIC, no depositor has ever lost a penny of an insured. With CDARS, the Certificate of Deposit Account Registry Service, you can access millions in FDIC insurance at participating network banks by working directly. Why is FDIC insurance important? The Federal Deposit Insurance Corporation (FDIC) exists to protect depositors' money held in banks. Its insurance limit. Whether an account is owned by one person or ten, each owner is insured up to $, For example, if an individual has a single account with a bank and that. Features and Benefits · Access to FDIC insurance through a single bank relationship · InsureGuard+ Savings deposits are eligible for multi-million dollar FDIC. Safety – Your money can receive up to $ million in FDIC insurance coverage. · Convenience – You work directly with us. · Community Investment – The full value. The standard insurance amount is $, per depositor, per insured bank, for each ownership category. This means that by having accounts in different. million-dollar FDIC insurance through participating network banks millions in aggregate FDIC insurance across network banks. Customer funds. All individual accounts at the same insured bank are added together and the total is insured up to $, For example, if you have an interest-bearing.