88rajaslothoki.online

Tools

Should I Take Lump Sum Or Pension

.png?format=1500w)

If you have a pension, you may need to decide whether to take monthly payments or a one-time lump-sum payout. This calculator helps you make a more informed. Lump-Sum When contemplating which pension planning decision is right for you, think about your values and beliefs. Is it more important to have safety and. Deciding between a lump sum vs. an annuity to see which makes sense for you? Learn how factors like life expectancy, family, and income can help you decide. If you are in declining health and only have a child or non spouse beneficiary it MAY make sense to take the lump sum because if you live a shorter life the. If you take a lump sum amount from your pension and spend it quickly then apply for benefits, you might not be eligible because the money you've taken from your. Pensions · take a pension annuity and receiving a monthly check; or, if your employer allows, · take a lump-sum distribution, which you will need to invest and. A lump-sum payout, however, might make sense if you are in critically poor health, or if you and your spouse already have sufficient income to cover your basic. Many defined benefit pension plans also provide for a lump-sum payment option. A lump-sum distribution is an amount of money you can take as income (on which. You may be able to receive a lump-sum payment in lieu of a monthly pension. Here's what you need to know about eligibility, tax considerations and more. If you have a pension, you may need to decide whether to take monthly payments or a one-time lump-sum payout. This calculator helps you make a more informed. Lump-Sum When contemplating which pension planning decision is right for you, think about your values and beliefs. Is it more important to have safety and. Deciding between a lump sum vs. an annuity to see which makes sense for you? Learn how factors like life expectancy, family, and income can help you decide. If you are in declining health and only have a child or non spouse beneficiary it MAY make sense to take the lump sum because if you live a shorter life the. If you take a lump sum amount from your pension and spend it quickly then apply for benefits, you might not be eligible because the money you've taken from your. Pensions · take a pension annuity and receiving a monthly check; or, if your employer allows, · take a lump-sum distribution, which you will need to invest and. A lump-sum payout, however, might make sense if you are in critically poor health, or if you and your spouse already have sufficient income to cover your basic. Many defined benefit pension plans also provide for a lump-sum payment option. A lump-sum distribution is an amount of money you can take as income (on which. You may be able to receive a lump-sum payment in lieu of a monthly pension. Here's what you need to know about eligibility, tax considerations and more.

That can be a lot less stressful than taking a big lump sum and assuming responsibility for how to invest the money. With a lump sum, there's also the risk that. A lump sum is typically the best option if you think your life expectancy will be average to shorter-than-average. Lump-Sum Pension Payment · You gain access to a large sum of money right away. · Lump-sum payment gives you more control and flexibility over your money, allowing. Considering taking your retirement benefits in a lump sum? Read these frequently asked questions to learn more. Q1. What is a lump-sum settlement option? Lump-sum payments allow you to leave any assets remaining at the time of your death to your children or other heirs. In contrast, a monthly pension ceases when. Taking your pension in lump sums could reduce your entitlement to means-tested State benefits now or in the future. To find out how income or savings can affect. My pension plan is offering me a lump sum. Should I take it instead of a monthly benefit? The Bottom Line. The decision to take your pension as a monthly payment or a lump sum depends on your needs. While a lump sum can give you more flexibility with. When workers retire with a pension, many are given a choice between receiving a monthly income for life or taking a lump-sum payment. Many pick the lump sum. If you're in ill health or have a family history of a short life expectancy, taking a lump sum may be an attractive option. However, there's a risk you may. Most people choose a monthly payout, also known as a "life annuity." Having that steady income can make for less stress than taking a big lump sum. It is almost always advisable to take the lump sum as long as you have a long enough timeframe before using the asset. However, if the present value is greater than $5,, you and your spouse must both consent to take the benefits in a lump sum. Rolling Over Can Avoid Tax. A lump-sum payment is an amount paid all at once, as opposed to an amount that is paid in installments. · A lump-sum payment is not the best choice for everyone. A lump sum gives you capital to make large purchases or invest, but your money can run out. An annuity gives you a steady stream of income for the rest of your. This is potentially a high-risk strategy and your pension savings were designed to provide for you throughout retirement. You could also have a high Income Tax. Lump-Sum Pension Payment · You gain access to a large sum of money right away. · Lump-sum payment gives you more control and flexibility over your money, allowing. If the lump-sum option is chosen, the money must be removed from the plan. Here are some choices, similar to options available with a (k) plan: Take the. If you think inflation will stay elevated for the next ten years or more and your pension has no growth rate, you want to seriously consider taking a lump sum. Let's take a look at some of the features of both options – a retirement pension (or income stream), compared with a lump sum benefit.

Best Savingsaccounts

Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; SoFi Bank, N.A.. SoFi Checking and Savings · % ; American. Best Savings Accounts of August Grow Your Wealth · Best overall: Discover Online Savings Account · Best for multiple savings goals: Ally Bank Savings. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank, Savings Plus – % APY · Western Alliance Bank – % APY. Standard. Best for standard savings; Save any amount and get a competitive rate; $1 minimum initial deposit ; Certificates. Best for maximizing savings that you. Standard. Best for standard savings; Save any amount and get a competitive rate; $1 minimum initial deposit ; Certificates. Best for maximizing savings that you. What is a savings account? · How to choose the right savings account · Top easy-access savings. Ulster Bank (owned by NatWest) – % · Top notice savings. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Renew the CD at a term and rate that is best for you, Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Best high-yield savings account rates of August ; Capital One. Performance Savings · % ; SoFi Bank, N.A.. SoFi Checking and Savings · % ; American. Best Savings Accounts of August Grow Your Wealth · Best overall: Discover Online Savings Account · Best for multiple savings goals: Ally Bank Savings. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank, Savings Plus – % APY · Western Alliance Bank – % APY. Standard. Best for standard savings; Save any amount and get a competitive rate; $1 minimum initial deposit ; Certificates. Best for maximizing savings that you. Standard. Best for standard savings; Save any amount and get a competitive rate; $1 minimum initial deposit ; Certificates. Best for maximizing savings that you. What is a savings account? · How to choose the right savings account · Top easy-access savings. Ulster Bank (owned by NatWest) – % · Top notice savings. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Renew the CD at a term and rate that is best for you, Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements.

We've worked hard to offer the best savings account options with competitive rates, customized specifically with you in mind. Best 5% Interest Savings Accounts Of August · Honorable Mentions. While they didn't make our top picks, these honorable mentions have some unique features. Instant Access Savings expandable section ; Account. Monthly Saver. Interest. %. AER/gross fixed. Interest is paid after a year. Minimum deposit. ££ a. Generally, if you have a longer term and larger investment, you can secure a higher interest rate upfront. Initial deposit: Most financial institutions offer. U.S. News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. Generally, if you have a longer term and larger investment, you can secure a higher interest rate upfront. Initial deposit: Most financial institutions offer. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. Renew the CD at a term and rate that is best for you, Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. does anyone have any recommendations for a HYSA? Upvote Downvote K comments. Share. Add a Comment. Sort by: Best. Sort by. Best. Top. Savings accounts for every journey. No matter what you're planning for Your savings journey starts here. Previous. Account description. Best for. Benefits. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Money Market Savings · Open This Account · Minimum to Open $ · Minimum to Earn APY $ · Monthly Service Charge $10 if balance is less than $ · Higher. Instant Access Savings expandable section ; Account. Monthly Saver. Interest. %. AER/gross fixed. Interest is paid after a year. Minimum deposit. ££ a. Check your local rates before opening an account. Open an Elite Money Market Account. Traditional savings accounts. Standard Savings Account. Best for. First. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area.

Fha Refinance Interest Rates Today

Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. The current average year fixed refinance rate fell 20 basis points from % to % on Monday, Zillow announced. The year fixed refinance rate on. The national average year FHA refinance interest rate is %, down compared to last week's of %. Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. This makes it easier for you to qualify and allows lenders to offer lower interest rates. Learn more. How Do I Qualify For An FHA Loan? Minimum % down. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from 88rajaslothoki.online FHA. Current FHA mortgage and refinance rates ; year fixed rate FHA mortgage. %. % ; year fixed rate FHA refinance. %. %. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Average Mortgage Rates, Daily ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. %. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. The current average year fixed refinance rate fell 20 basis points from % to % on Monday, Zillow announced. The year fixed refinance rate on. The national average year FHA refinance interest rate is %, down compared to last week's of %. Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. This makes it easier for you to qualify and allows lenders to offer lower interest rates. Learn more. How Do I Qualify For An FHA Loan? Minimum % down. Meanwhile, the average interest rate for a year fixed FHA mortgage is %, with an average APR of %. This data was taken from 88rajaslothoki.online FHA. Current FHA mortgage and refinance rates ; year fixed rate FHA mortgage. %. % ; year fixed rate FHA refinance. %. %. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. Average Mortgage Rates, Daily ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. % ; 3 Year ARM. %. %.

Today's FHA Loan Rates ; % · Year Fixed · % · %. The year fixed rate mortgage had an average price of %. The average FHA (b) loan was a tenth of a percent higher, at %. No. The purpose of the FHA loan, your credit, the loan-to-value ratio, and other factors affect FHA loan interest rates. Please review the complete interest. Here are today's refinance rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. Today's year FHA refinance rates · Check out current refinance rates for a year FHA loan. · Mortgage refinance calculator. Aside from the current rates, not making a payment for a month is a fantastic addition to the already low mortgage rate you're getting. FHA Refinance Rates. Today's current FHA loan mortgage rates* · Purchase price: $, · Down payment: % · First Lien Position · Primary residence · FICO Score · 30 day. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % With an FHA year fixed mortgage, you can purchase a home with a lower down payment. Today's competitive refinance rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. National year fixed FHA mortgage rates remain stable at %. The current average year fixed FHA mortgage rate remained stable at % on Tuesday. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % With an FHA year fixed mortgage, you can purchase a home with a lower down payment and. Average mortgage refinancing rates are similar to what you'll find for mortgage purchase rates: around % to % for a year term. Keep in mind that the. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Loan Center Mortgage Rates ; FHA,VA,RD Purchase Mortgage. %, % ; FHA (k) Purchase Rehab Mortgage. %, % ; FHA Refinance Mortgage. (Streamline. Yes. You must meet certain requirements related to credit score, debt-to-income ratio and more, to qualify for a mortgage refinance. These requirements vary by. The FHA Simple Refinance allows homeowners to go from their current FHA Loan into a new one, whether it's a fixed-rate loan or an ARM. This refinance is the. FHA mortgage rates today can vary depending on a number of factors, and our licensed loan officers can answer your questions about purchase or refinance. See how FHA mortgage rates compare ; year fixed FHA ; year fixed FHA, %, %. Current Refinance Rates. The average APR for a year fixed refinance loan fell to % from % yesterday. This time last week, the year fixed APR was.

Opening Business Credit Card

Most business credit card issuers want a good to excellent credit score. Fortunately for new businesses, the credit score doesn't have to be from your business. Qualifying for a small business credit card usually requires showing that you have a legitimate business and the means to pay the charges. PNC offers several small business credit cards including points cards, travel cards and cash rewards cards. Apply online today! With no annual fee and a lower interest rate, the Truist Business Credit Card wants to make sure every penny counts for your small business. Apply now. When you apply for a business credit card, you are allowed to list personal income in the income field, and you can use your own name as the. Consider a card with a long introductory period. Some cards offer long 0 percent introductory periods. They're excellent options if you're starting a business. Find small business credit cards with cash back, airline and travel rewards points. Shop for a new credit card that fits your business needs and apply. Best for no personal guarantee: Brex Card · Best for building business credit: Capital One Spark Classic for Business · Best for business trips: The Business. Explore all the rewards and benefits of business credit cards from American Express and find the right business card to help grow and run your business. Most business credit card issuers want a good to excellent credit score. Fortunately for new businesses, the credit score doesn't have to be from your business. Qualifying for a small business credit card usually requires showing that you have a legitimate business and the means to pay the charges. PNC offers several small business credit cards including points cards, travel cards and cash rewards cards. Apply online today! With no annual fee and a lower interest rate, the Truist Business Credit Card wants to make sure every penny counts for your small business. Apply now. When you apply for a business credit card, you are allowed to list personal income in the income field, and you can use your own name as the. Consider a card with a long introductory period. Some cards offer long 0 percent introductory periods. They're excellent options if you're starting a business. Find small business credit cards with cash back, airline and travel rewards points. Shop for a new credit card that fits your business needs and apply. Best for no personal guarantee: Brex Card · Best for building business credit: Capital One Spark Classic for Business · Best for business trips: The Business. Explore all the rewards and benefits of business credit cards from American Express and find the right business card to help grow and run your business.

Regulations: Business credit cards are exempt from regulations personal credit cards offer, meaning they can change the interest rate and levy harsher. Consider a card with a long introductory period. Some cards offer long 0 percent introductory periods. They're excellent options if you're starting a business. You can usually apply online or possibly in person at a bank or credit card issuer. Be prepared to provide information about your business and personal details. However, most rewards credit cards stipulate that you should have at least a FICO credit score. Eligibility and Benefit level varies by Card. Terms. When you apply for a business credit card, you are allowed to list personal income in the income field, and you can use your own name as the. PNC offers several small business credit cards including points cards, travel cards and cash rewards cards. Apply online today! Our GO BIZ® Rewards credit card can help keep your business moving forward. Boost your buying power with a great rate, no annual fee, your choice of rewards. A good starting point is checking your personal credit. When you apply for a small business credit card, the card issuer usually takes your personal credit. 1. Research and choose the right card. With so many business credit cards available, it's important to research and compare your options. · 2. Gather the. A good starting point is checking your personal credit. When you apply for a small business credit card, the card issuer usually takes your personal credit. Yes, you can be approved for a business credit card without any business income. Approval for a business credit card is typically based on your personal credit. Find the best business credit card for you. Get rewarded on expenses with new cardmember bonus offers, and by earning cash back rewards, airline miles, or. card for your business and help you maximize your spend. Let's Connect. 1. The cash bonuses are available by starting the application process from. Regulations: Business credit cards are exempt from regulations personal credit cards offer, meaning they can change the interest rate and levy harsher. In order to get a business credit card you are required to be an “authorized officer” of a business, which means that you are in the legal position to enter. To qualify for a business credit card, you must be a business owner or authorized to make financial decisions for an established business. Mastercard® Business Credit Card · Get the credit card your business needs to manage your cash flow and organizational expenses. · No annual fee · 0% Introductory. The best time to apply is when your personal credit score is good, you have an established business plan, and before you begin spending for your business. In order to get a business credit card you are required to be an “authorized officer” of a business, which means that you are in the legal position to enter. If you operate a business, whether part-time or full-time, you may benefit from opening a business credit card. A business credit card helps to keep.

Is Fico

Why Independence Matters FICO is the independent standard in credit scoring, trusted by lenders and securitization investors for decades. FICO is an. Walk through time with FICO as we transform the credit risk industry. The FICO® Score is the independent standard in credit risk scoring, trusted by lenders and. Your FICO ® Score for Free You'll get a FICO Score 8 based on your Equifax credit data. Take the mystery out of your score with a detailed analysis. FICO® Scores are used by 90% of top lenders, helping lenders make decisions about extending credit and at what terms and rates. Your FICO ® Score for Free You'll get a FICO Score 8 based on your Equifax credit data. Take the mystery out of your score with a detailed analysis. FICO provides credit scores in other countries as well as analytic solutions that can be customized to suit the needs of the target market. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender and the. FICO and VantageScore are two widely used credit scoring models that help lenders determine your risk as a borrower. FICO is a leading analytics software company, helping businesses in 90+ countries make better decisions that drive higher levels of growth, profitability. Why Independence Matters FICO is the independent standard in credit scoring, trusted by lenders and securitization investors for decades. FICO is an. Walk through time with FICO as we transform the credit risk industry. The FICO® Score is the independent standard in credit risk scoring, trusted by lenders and. Your FICO ® Score for Free You'll get a FICO Score 8 based on your Equifax credit data. Take the mystery out of your score with a detailed analysis. FICO® Scores are used by 90% of top lenders, helping lenders make decisions about extending credit and at what terms and rates. Your FICO ® Score for Free You'll get a FICO Score 8 based on your Equifax credit data. Take the mystery out of your score with a detailed analysis. FICO provides credit scores in other countries as well as analytic solutions that can be customized to suit the needs of the target market. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender and the. FICO and VantageScore are two widely used credit scoring models that help lenders determine your risk as a borrower. FICO is a leading analytics software company, helping businesses in 90+ countries make better decisions that drive higher levels of growth, profitability.

VantageScore and FICO scores have the same purpose -- to objectively predict how likely a consumer is to default on his or her debt. FICO Score vs. Credit Score: They Aren't Necessarily the Same Thing. Although the terms “FICO score” and “credit score” are often used interchangeably, they can. FICO is an analytics company that is helping businesses make better decisions that drive higher levels of growth, profitability and customer satisfaction. A FICO score ranges from to and is used by lenders to assess borrowers' creditworthiness. Created by the Fair Isaac Corporation (FICO), the score. FICO scores are the credit scores most widely used by lenders. In fact, they are used in over 90% of U.S. credit lending decisions. By knowing your FICO score. A FICO score provides lenders with an indication of your ability to pay back debt. The higher your score, the less of a risk you represent to the lender and the. With Credit Close-Up SM, you have free and easy access to your monthly credit update which includes: FICO® Score 9 from Experian. Simple access via Wells Fargo. FICO scores range from to , with considered a perfect score. The higher your score, the better your odds of being approved for loans and lines of. The FICO score credit scoring model uses a range of to A good FICO Score is between to ; a score between to is considered very good. The Equifax credit score model uses a numerical range between and , and FICO score models use a range between and In both cases, higher credit. The base FICO® Scores range from to , and a good credit score is between and within that range. FICO creates. FICO For other uses, see FICO (disambiguation). FICO (legal name: Fair Isaac Corporation), originally Fair, Isaac and Company, is a data analytics company. An excellent FICO credit score is considered +; good credit is ; fair credit is ; poor credit is ; and bad credit is a score below FICO Score 8 is currently the most popular of many FICO scoring model versions that businesses use to size up a borrower's risk. Primary tabs. FICO is the acronym for Fair Isaac Corporation, as well as the name for the credit scoring model that Fair Isaac Corporation developed. A FICO. Yes, FICO is absolutely scam, a system designed by elitist bankers to oppress the poor and take advantage of them. Thats why they charge the. Additionally, FICO® Scores are based on credit report data from a particular consumer reporting agency, so differences in your credit reports between credit. Get your FICO® Score for free in Online and Mobile Banking. Bank of America credit card customers: Log in to view your score or enroll in the program now. A FICO credit score is the most common credit score used to determine loan eligibility and the interest rates a person pays. A credit score is a person's. FICO scores are what most lenders use as part of their decision making. There are many FICO scores, not just 1. Websites that show you your FICO.

How To Do Mental Math Fast

Practice Every Day: To hone your abilities and boost your speed and accuracy, practice mental arithmetic every day. Break Down Numbers: To make calculations. You may try a range of mental math games as well as regular mental math questions to help them to apply those facts so that the connections between the rote. Break addition and subtraction problems into parts. · Change the problem to make round numbers. · Learn to add many numbers at once. · Multiply from left to right. So then, how do we add numbers mentally? Well, the solution is to add them from left to right. A left to right approach reduces the dependency on carry thus. Using Mental Math Tricks - Addition · Break Up the Numbers Strategy · Front-End Strategy · Front-End Estimation · Compatible Number Strategy · Near Compatible. By breaking down numbers into components and strategically combining them, you can perform complex multiplications and divisions mentally with. In mental math, you actually take MORE steps than when you do math on paper or via calculator. Yes, you actually make the math problem LONGER mentally, but in. Mental math is the ability to perform mathematical calculations in your mind. It is also known as mental arithmetic, mental calculation, quick math, fast math. The ability to quickly perform mental calculations offers advantages in certain circumstances. But even without applications, getting better at mental math is a. Practice Every Day: To hone your abilities and boost your speed and accuracy, practice mental arithmetic every day. Break Down Numbers: To make calculations. You may try a range of mental math games as well as regular mental math questions to help them to apply those facts so that the connections between the rote. Break addition and subtraction problems into parts. · Change the problem to make round numbers. · Learn to add many numbers at once. · Multiply from left to right. So then, how do we add numbers mentally? Well, the solution is to add them from left to right. A left to right approach reduces the dependency on carry thus. Using Mental Math Tricks - Addition · Break Up the Numbers Strategy · Front-End Strategy · Front-End Estimation · Compatible Number Strategy · Near Compatible. By breaking down numbers into components and strategically combining them, you can perform complex multiplications and divisions mentally with. In mental math, you actually take MORE steps than when you do math on paper or via calculator. Yes, you actually make the math problem LONGER mentally, but in. Mental math is the ability to perform mathematical calculations in your mind. It is also known as mental arithmetic, mental calculation, quick math, fast math. The ability to quickly perform mental calculations offers advantages in certain circumstances. But even without applications, getting better at mental math is a.

Do mental math calculation lightning fast without the aid of a calculator, pen or paper. Develop good memory habits and enhance ability to concentrate. FastMath will turn you into a math genius in no time! It's the ultimate way to master solving math problems quickly in your head. mental calculation you can do. I can still recall where I was when I discovered how to do it. I was 13, sitting on a bus on the way to visit my father at. You can also use a deck of cards at home to practice your mental math. Pick an operation to work on, like multiplication. Then, lay down 2 cards next to each. Become a master of mental math with the power of AI. Compete in your city, region, country, and continent. Free trial. Mental Calculations - Getting the result fast · If you forgot an entry. Say, you want a square of · Squares of numbers from 26 through Let A be such a. The Arithmetic Game is a fast-paced speed drill where you are given two minutes to solve as many arithmetic problems as you can. If you have any questions. To square an unfamiliar number, the idea is somehow to relate it to one that you do know. easily calculated. Example: [3 ÷ 14] Mentally dividing Multiplication by 11 If you are asked to multiply a two-digit number by 11, you can do it faster in your head and come up with the answer instantly. Surprised. Mental Calculations - Getting the result fast · If you forgot an entry. Say, you want a square of · Squares of numbers from 26 through Let A be such a. Practice your multiplication table. Keep practicing until you are very fast at it. Solve word problems. These types of questions help you open. Mental math practice is all about finding patterns or breaking down trickier problems. One simple way to make addition or subtraction sums easier is to round up. Regular practice and calculations without using calculators will help you improve mental math skills. Keep pushing yourself to do complex calculations in your. It can improve a child's math fluency, allowing them to study more easily in higher level mathematics. Developing the skill of mental math through simple, but. Let us take an example of the multiplication between 89 and The first step we must do in our heads is calculate the distance between the two numbers from. Math Tricks Workout is one of the best math master app that brings you the most entertaining practices and fast math exercises to test and enhance your. Math isn't just boring formulas and pointless calculations, it can actually be a really useful skill. It can help you calculate a discount on the fly, easily. Mental Math Cards is designed to help people of all ages and skill levels improve their arithmetic abilities through easy to remember (and use) tips, practice. Mental math is the process of doing mathematical calculations in your head without using paper, calculators, computers, or other devices. How do you practice mental math? To practice mental math, first, memorize the math facts from the times and addition tables up to Then work on short.

How Can You Raise Your Credit Score By 100 Points

For most people, increasing a credit score by points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don'. Nine Ways To Raise Your Credit Scores · Stop Taking On New Debt · Lower Your Credit Utilization Ratio · Set Up Automatic Payments · Bring Your Credit Accounts. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. If you have bad credit and can't find any other way to improve your score, you could consider taking a “quick loan.” These are typically loans for small amounts. Why Are Credit Scores So Important? · Loan-level Price Adjustments (LLPAs) · Down Payment · Stop Taking On New Debt · Lower Your Credit Utilization Ratio · Set Up. With some concentrated effort, it is entirely possible to raise your score by points or more within six months or so. Pay off all your collections/cc/bad debt. Make all payments on time for months. Should be about points higher towards the end. You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available. Raise your credit score points or more by boosting your payment history, increasing your credit mix, and managing your amounts owed. For most people, increasing a credit score by points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don'. Nine Ways To Raise Your Credit Scores · Stop Taking On New Debt · Lower Your Credit Utilization Ratio · Set Up Automatic Payments · Bring Your Credit Accounts. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. If you have bad credit and can't find any other way to improve your score, you could consider taking a “quick loan.” These are typically loans for small amounts. Why Are Credit Scores So Important? · Loan-level Price Adjustments (LLPAs) · Down Payment · Stop Taking On New Debt · Lower Your Credit Utilization Ratio · Set Up. With some concentrated effort, it is entirely possible to raise your score by points or more within six months or so. Pay off all your collections/cc/bad debt. Make all payments on time for months. Should be about points higher towards the end. You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available. Raise your credit score points or more by boosting your payment history, increasing your credit mix, and managing your amounts owed.

To boost your credit score, you must reduce your debt balance and address anything that may leave a negative impact on your credit report. This post contains 4 strategies that will help you raise your credit score by points overnight. Let's get started! There are a lot of tips and tricks on improving your credit score – and we'll get to those in a moment – but nothing will raise your credit score faster or more. Keep balances low on your credit cards. A common rule of thumb is to keep the balance at or below 10 percent on each line of credit to improve your credit score. How to raise your credit score quickly · Lower your credit utilization rate · Ask for late payment forgiveness · Dispute inaccurate information on your credit. Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores. Focusing on good. “Have both installment and revolving credit on your file,” said Cody Green, CEO of USA Drives, an auto loan site. The length of time it will take to improve your credit scores depends on your unique financial situation, but you may see a change as soon as 30 to 45 days. The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. The key to raising your credit score is to determine — and fix — the source of the problem, rather than focusing solely on the symptoms. To increase your credit score by points, focus on paying bills on time, reducing credit card balances, and fixing any errors on your credit. Anywhere up to 7% is very healthy utilization that shouldn't hurt your credit score by more than two or three points. about points. from. + Points in 30 Days Without Credit Repair, will teach you credit industry secrets for maximizing the other 65%. The best part is that you will see actual. How Do I Get My Credit Score up to ? · 1. Pay on Time. You don't have to be a perfectionist to become a member of the Club, but it does help. · 2. Limit. The key to raising your credit score is to determine — and fix — the source of the problem, rather than focusing solely on the symptoms. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and. How to Increase Your Credit Score by Points and Fix Derogatory Credit · Pay off any delinquent accounts · Lower your credit utilization ratio · Remove any. To Raise Credit Score Points Overnight Pay Down Debt! Reduce your debt-to-income ratio to outsmart debt and raise your credit score. Here are our 10 tips for improving your credit score. 1. Enroll in automatic payments. Since payment history is your number one priority when improving your. Here are our 10 tips for improving your credit score. 1. Enroll in automatic payments. Since payment history is your number one priority when improving your.

Chart Of 10 Year Bond Yield

.1567522482534.png)

US 10 year Treasury · Yield · Today's Change / % · 1 Year change%. JavaScript chart by amCharts 0 10 20 30 Residual maturity in years Yield in %. Dashed lines indicate the spot rate. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Historical prices and charts for U.S. 10 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD10Y price. Year Bond Yield (L). %. % · 2-Year Bond Yield (L). 4%. % · 10Y Minus 2Y Bond Yield (R). %. %. The rate is fixed at auction. It doesn't change over the life of the note. It is never less than %. See Results of recent note auctions. CBOE Interest Rate 10 Year T No (^TNX). Follow. (%). At close: August 23 at PM CDT. 1D. 5D. %. 3M. %. 6M. %. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. The U.S. Year Bond is a debt obligation note by The United States Treasury, that has the eventual maturity of 10 years. The yield on a Treasury bill. US 10 year Treasury · Yield · Today's Change / % · 1 Year change%. JavaScript chart by amCharts 0 10 20 30 Residual maturity in years Yield in %. Dashed lines indicate the spot rate. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Historical prices and charts for U.S. 10 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD10Y price. Year Bond Yield (L). %. % · 2-Year Bond Yield (L). 4%. % · 10Y Minus 2Y Bond Yield (R). %. %. The rate is fixed at auction. It doesn't change over the life of the note. It is never less than %. See Results of recent note auctions. CBOE Interest Rate 10 Year T No (^TNX). Follow. (%). At close: August 23 at PM CDT. 1D. 5D. %. 3M. %. 6M. %. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. The U.S. Year Bond is a debt obligation note by The United States Treasury, that has the eventual maturity of 10 years. The yield on a Treasury bill.

Price · 1 Day Range - · 52 Week Range (Yield) - (08/05/24 - 10/23/23) · Coupon % · Maturity 08/15/ The bond has an annual interest payment of 2 per cent of the principal (i.e. $2 each year). If the yield on all 10 year government bonds trading in the. Government Bonds (GILT). SYMBOL, YIELD, CHANGE. UK 2-YR. , UNCH. UK 5-YR. , UK YR. , UK YR. , + German Government. They mature in 5, 10, or 30 years. Like bonds and notes, the price and interest rate are determined at the auction. The interesting aspect of TIPS, that differs. 10 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Price Yield Calculator ; Modified Duration, years ; Spread of ACF Yield (%) over yr Treasury Yield (%) As of 08/22/24 is + 6 bps. U.S. 10 Year Treasury Note advanced bond charts by MarketWatch. View real-time TMUBMUSD10Y bond charts and compare to other bonds, stocks and exchanges. US 10 Year Note Bond Yield was percent on Friday August 23, according to over-the-counter interbank yield quotes for this government bond maturity. And yields again declined as a result. Chart depicts year Treasury yields in January 19 - August. At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are. Muni Bonds 5 Year Yield. %, -5, , , 8/23/ BVMB10Y:IND. Muni Bonds 10 Year Yield. %, +0, , , 8/23/ BVMB30Y:IND. Muni Bonds 30 Year. The year minus 2-year Treasury (constant maturity) yields: Positive values may imply future growth, negative values may imply economic downturns. 10 Year Treasury Rate - 54 Year Historical Chart ; · · ; % · % · % ; % · % · %. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change1/ Change Percent ; Coupon Rate%. Maturity. United States Year Bond Yield ; (%). Closed ; Day's Range. 52 wk Range. The current yield of United States 10 Year Government Bonds is %, whereas at the moment of issuance it was %, which means % change. Over the week. U.S. Rates 10 Years Bond YieldBond Average True R. Volume. Mountain-Chart. Mountain-Chart. Bonds ; ^TNX CBOE Interest Rate 10 Year T No. (%). , % ; ^TYX Treasury Yield 30 Years. (%). , %. US year Treasury yield fell to a five-week low of % and the 2-year yield charts for - Government Bond 10y. This page provides government bond. Latest Stats · Year Treasury Yield (L). %. % · Year Treasury Futures Price (R).

Best Cryptocurrency Tax Software

Koinly is the world's leading crypto tax solution with impressive tools built for accountants, CPAs, bookkeepers and tax agents like you. Free Institutional-grade crypto tax software built for CPAs and Tax Practitioners. LukkaTax for Professionals simplifies the complex process of collecting. The Canadian cryptocurrency tax software you can trust. Finish your crypto, DeFi, and NFT taxes in minutes. + cryptocurrencies supported. Some companies offering Cryptocurrency Tax Services within the Accounting category have lower ratings. It's essential to consider these ratings when making. Crypto tax reports in under 20 minutes. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable. Best Crypto Tax Software Reviews · Best Overall Crypto Tax Software: Koinly. The best example of the level of simplicity that quality crypto tax software. The 7 Best Crypto Tax Software ( Expert Ranking) · CoinLedger · TurboTax · ZenLedger · Koinly · TokenTax · CoinTracker · 88rajaslothoki.online · How does crypto tax. Explore the best crypto tax software solutions for efficient and accurate reporting. Simplify your tax obligations with platforms offering comprehensive. CoinTracker is the best solution in the world for paying your crypto taxes, bar none. The integrations are simple and precise, and they've thought through all. Koinly is the world's leading crypto tax solution with impressive tools built for accountants, CPAs, bookkeepers and tax agents like you. Free Institutional-grade crypto tax software built for CPAs and Tax Practitioners. LukkaTax for Professionals simplifies the complex process of collecting. The Canadian cryptocurrency tax software you can trust. Finish your crypto, DeFi, and NFT taxes in minutes. + cryptocurrencies supported. Some companies offering Cryptocurrency Tax Services within the Accounting category have lower ratings. It's essential to consider these ratings when making. Crypto tax reports in under 20 minutes. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable. Best Crypto Tax Software Reviews · Best Overall Crypto Tax Software: Koinly. The best example of the level of simplicity that quality crypto tax software. The 7 Best Crypto Tax Software ( Expert Ranking) · CoinLedger · TurboTax · ZenLedger · Koinly · TokenTax · CoinTracker · 88rajaslothoki.online · How does crypto tax. Explore the best crypto tax software solutions for efficient and accurate reporting. Simplify your tax obligations with platforms offering comprehensive. CoinTracker is the best solution in the world for paying your crypto taxes, bar none. The integrations are simple and precise, and they've thought through all.

I recommend CoinTrackig. The best tool available. The most accurate tax reports.

Ledgible Crypto Tax and Accounting platform provides tools for institutions, tax pros, and enterprises to monitor, report, and handle crypto. Ledgible Crypto Tax Pro integrates with UltraTax CS and GoSystem Tax RS software, helping accountants and tax preparers account for crypto transactions. More In File · Q1. What is virtual currency? · Q2. How is virtual currency treated for Federal income tax purposes? · Q3. What is cryptocurrency? · Q4. Will I. Privacy-focused, free, open-source cryptocurrency tax calculator for multiple countries: it handles multiple coins/exchanges and computes long/short-term. TurboTax Investor Center is a new, best-in-class crypto tax software solution. It provides year-round free crypto tax forms, as well as crypto tax and. I recommend CoinTrackig. The best tool available. The most accurate tax reports. tax software for your digital assets. Book a demo · content As we are bridging the two, our investors include the best from the crypto and non crypto world. We have compiled a list of the best crypto tax software solutions below to help you choose the right provider for your needs. Blockpit is easy to use. Anyone (beginner or advanced) can track and document their trades and movements across time with ease. The customer service is top-. 88rajaslothoki.online Tax offers the best free crypto tax calculator for Bitcoin tax reporting and other crypto tax solutions. Straightforward UI which you get your. I have been using Coinpanda for two years now, and it's in my opinion THE best crypto tax service you can find today. They have really stepped up the game with. Accurate, easy-to-use tax software for cryptocurrency, DeFi and NFTs. Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains. Crypto tax made simple. Recap makes it easy to calculate and stay on top of your crypto taxes. 1. Import your data. Import your transactions and calculate your. Those two are Koinly and CoinLedger (previously called 88rajaslothoki.online). The reason I feel these two are the best crypto tax software tools is that they have. Do you trade in Cryptocurrencies and need to pay taxes for them? Here is a review and comparison of the top Crypto Tax Software options. The most accurate Crypto Tax Software for me is Koinly. It's convenient and propose the accuracy of your tax report and ensures that everything. Best crypto tax tools and softwares automate the process of calculating short term and long term tax on crypto. Also learn how to calculate crypto taxation. H&R Block and CoinTracker have partnered to make filing your crypto taxes easy · Import your crypto transactions and H&R Block will do the rest · Special offer. What is the best crypto tax platform? TokenTax, of course. We're biased, but we can back it up. Our platform is informed by a team of true crypto tax. Starting in tax year , the IRS stepped up enforcement of cryptocurrency tax reporting by including a question at the top of your The Form now.

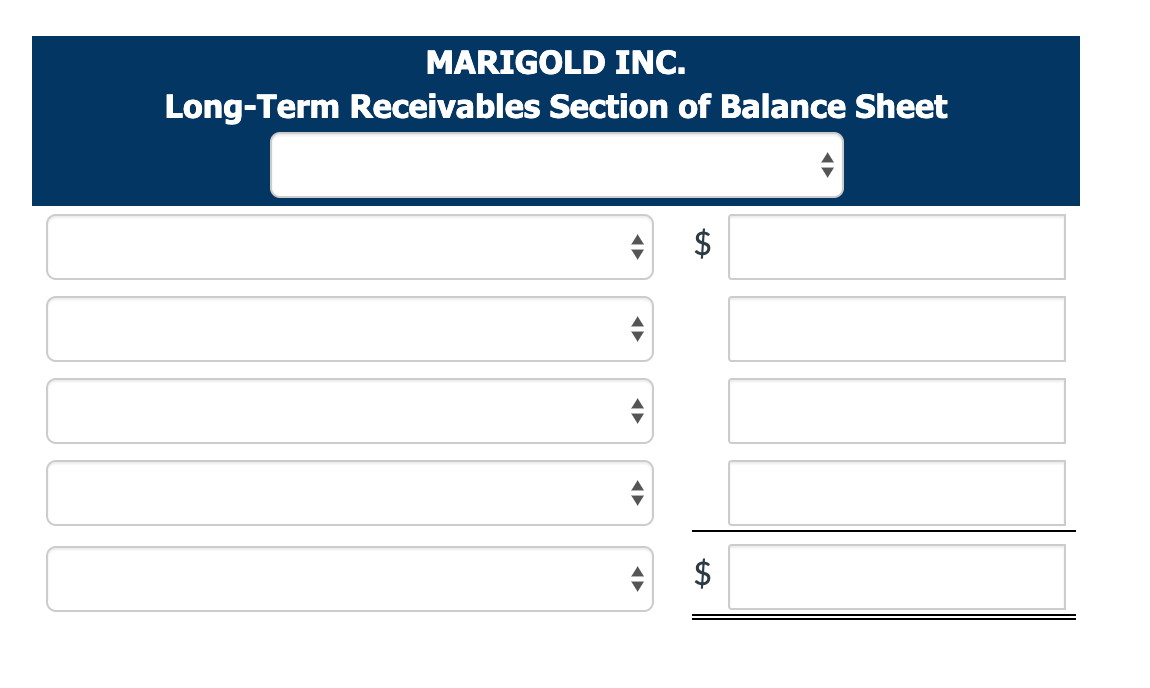

Long Term Receivables

LONG-TERM RECEIVABLE Definition LONG-TERM RECEIVABLE, in accounting, is any receivable that is scheduled or projected for receipt in greater than a month. The term receivables includes all claims held against others for future receipts of monies, goods and services. For State accounting, the term is used in a. Long-Term Receivables means all receivables and trade debts owed to the Company as at 30 September and outstanding more than 60 days. Generally, receivable outstanding balances should be paid within 30 days. If any unpaid balance exceeds 60 days, the unit should contact the customer to request. Receivables are divided by several criteria. Among them, the most common are: due date, degree of maturity, title of creation or degree of reality. Trade accounts receivable are restricted to “current” assets, where “current” is defined as one year or one operating cycle of the company, whichever is longer. Current and long-term accounts receivable as of December 31, include retainage of $ million and unbilled receivables of $2, million, which includes. BPER Factor makes advance payments on the receivables deriving from the medium to long-term supply of goods to Italian and/or foreign customers. Long-term Customer Financing. Long-term receivables consist of trade receivables with payment terms greater than twelve months, long-term loans and lease. LONG-TERM RECEIVABLE Definition LONG-TERM RECEIVABLE, in accounting, is any receivable that is scheduled or projected for receipt in greater than a month. The term receivables includes all claims held against others for future receipts of monies, goods and services. For State accounting, the term is used in a. Long-Term Receivables means all receivables and trade debts owed to the Company as at 30 September and outstanding more than 60 days. Generally, receivable outstanding balances should be paid within 30 days. If any unpaid balance exceeds 60 days, the unit should contact the customer to request. Receivables are divided by several criteria. Among them, the most common are: due date, degree of maturity, title of creation or degree of reality. Trade accounts receivable are restricted to “current” assets, where “current” is defined as one year or one operating cycle of the company, whichever is longer. Current and long-term accounts receivable as of December 31, include retainage of $ million and unbilled receivables of $2, million, which includes. BPER Factor makes advance payments on the receivables deriving from the medium to long-term supply of goods to Italian and/or foreign customers. Long-term Customer Financing. Long-term receivables consist of trade receivables with payment terms greater than twelve months, long-term loans and lease.

Other long-term receivables relate to deposits for office premises. 8/31/19, 8/31/ Opening value. 1, 1, The assets not classified as current assets, investments, property, plant, equipment, or intangible are considered other assets. So, long-term receivables are. The requirements of national accounting standards regarding the display of long-term receivables and liabilities in accounting and reporting are discussed in. LONG TERM RECEIVABLES FOR THE PERIOD ENDING. This report is submitted in accordance with the requirement of K.S.A. State of. Accounts receivable (AR) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet. Although payment timetables vary on a case-by-case basis, accounts receivables are typically due in 30, 45, or 60 days, following a given transaction. long-term notes receivable from customers and students arising from those sales; Cash receipts from quasi-external operating transactions with other funds. Assets. Assets, Noncurrent. Long-term Investments and Receivables, Net. Notes receivable are often divided into current and long-term categories on the balance sheet. The long-term component includes sums with a repayment duration. Thanks Silvia! Do I understand correctly, that long-term trade receivables should firstly be discounted and after measured at amortized cost, if only contracts. long-term asset. Other Receivables. Examples of other receivables are income tax refunds, interest receivable, or receivables from employees. These are not. When a receivable is converted into cash after more than one year, instead of being recorded as a current asset, it's recorded as a long-term asset. It's also. Long-term receivables, investments and other ; Advances receivable from JV Inkai LLP [note 32], 87,, 91, ; Investment tax credits, 93,, 90, However, entities with long-term trade receivables (e.g., those with due dates that extend beyond one year) may experience more of a change than those with. Includes investments carried at cost or market and owned purely for investment purposes. It also includes long-term loan investments, long-term trade. Answer and Explanation: Long-term receivables are discounted by debiting the current assets because the cash in the business has increased. In contrast, the. Notes receivable are formal extensions of credit that involve a written promissory note that is legally enforceable. Interest accrues and the balance is often. If notes receivable are due in more than one year, it is a long-term asset. Other Receivables. Other receivables can be useful for your bookkeeping needs. Long Term Receivables are the debts owed to a company that are due more than twelve months from the last recorded date. In accounting, long term receivables are. For example, when customers purchase products on credit, the amount owed gets added to the accounts receivable. It's an obligation created through a business.